Company Name

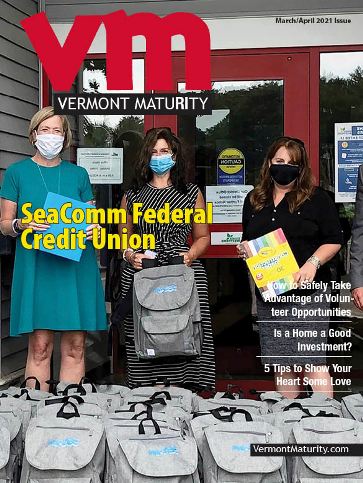

SeaComm Credit Union

Year Business Started

1963

Total Number of Employees

139

President and Chief Executive Officer

Scott A. Wilson

About SeaComm Credit Union

If you are looking for a full suite of financial services, no matter where you are in life’s journey, you will find it at SeaComm. As a SeaComm member, you have numerous savings options, which includes Regular Savings; Money Market Accounts; Certificates of Deposit; Individual Retirement Accounts (IRA); Health Savings Accounts (HSA); Club Accounts and Youth Savings Accounts for young savers. SeaComm members may also take advantage of our free checking account, or upgrade to a Benefits Plus® or Benefits Plus® Premium checking, which entitles you to exclusive savings on purchases for travel, groceries, restaurants, movies, prescriptions and much more. Choose from a variety of loans including personal loans; lines of credit; VISA® credit cards; new and used auto loans; recreational vehicle (RV) loans; mobile home loans; home equity loans; mortgages; commercial real estate loans; short term business notes; business term loans; and more. SeaComm members have access to their finances through a variety of 24/7 online digital platforms, such as NetTeller™ online banking, SmartLine telephone teller, SeaComm Pay mobile spending wallet, and SeaComm’s Mobile 4.0 app.

What Makes us Different

Unlike a traditional bank, SeaComm is a member owned, cooperative financial institution. Our credit union exists to serve its members and community, not a distant corporation in search of a profit. The money that SeaComm earns goes right back to our members in the form of dividends and a higher return on savings, whereas banks use surplus earnings to provide financial returns to their investors.

SeaComm offers a rich assortment of advantages that banks cannot offer. This includes a network of surcharge free ATMs, lower interest rates on mortgages and loans, credit cards with no annual fees, and LoanEngine™, a loan pre-approval program that allows our members to view and accept personalized loan offers without having to come into a branch or fill out an application.

In addition to our full suite of online services, SeaComm members also have the ability to deposit checks right from their mobile device, with Mobile Deposit Capture. This feature provides the ultimate convenience for our members, giving them access to their money without having to come into a branch.

At SeaComm, your money is ethically handled, and insured by the National Credit Union Administration (NCUA) up to $250,000. You can rest easy knowing your finances are safe.

We pride ourselves on being a trusted credit union, putting the needs of our members first.

Our History

In 1963, ten visionary employees of GM Corporation invested $5 each to obtain a share in a newly formed organization that we know today as SeaComm Federal Credit Union. SeaComm is now home to more than 48,000 members, with assets exceeding $568 million. As our credit union continues to grow, so does our ability to deliver quality financial services with cutting-edge technology. With the help of our friendly, professional staff and a strong dedication to our membership, we plan to strengthen the communities we serve for many years to come. To learn more and join our movement, visit Seacomm.org.

Contact Information

SeaComm Credit Union

1680 Shelburne Road

South Burlington VT 05403

Phone – 800-764-0566

Seacomm.org

Matt Sjoblom, South Burlington Branch Manager

msjoblom@seacomm.org

Related Articles & Free Subscription

Avoiding 4 Common Retirement Planning Mistakes

Don’t Play Politics with Your Portfolio

Comment here