There’s no debating that we are living through unprecedented and challenging times right now. While many are combating this pandemic on the front lines, many more of us are following the “stay home, stay safer” model prescribed by our leaders. And staying home may be on our agenda for longer than originally expected or what some of us think we can tolerate. The binge-watching, the banana bread baking, the macaroni necklace crafting, the mask-sewing, the spring cleaning, closet organizing, and the list goes on. Have you run out of ways to spend your time at home?

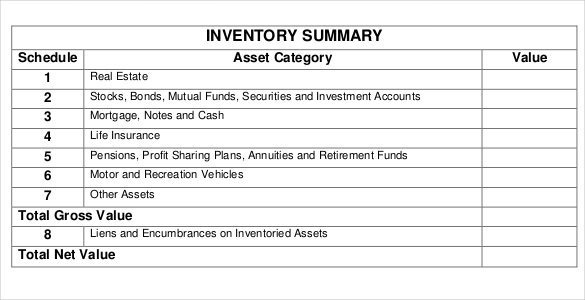

Here’s another suggestion: indoor scavenger hunt—estate edition. How quickly can you locate your estate plan and related documents? Your search list may include a trust, will, durable power of attorney, medical directive, deeds, and life insurance policies. Extra credit items include an asset inventory and password list. Ready, set, go! If it took you a while to locate these items, perhaps you need to improve your storage systems. A fire-proof safe at home is a great option, but the key to storage is notifying a trusted individual as to the whereabouts of those documents.

To pass a bit more time, before you re-file and properly store these documents, you could take a peek at them. While documents that you signed years ago do not become invalid or stale merely due to the passage of time, they can become inconsistent with current wishes. Confirm that the provisions still reflect your goals about the distribution of your assets and who is in charge of certain decisions. For example, the brother you named as Executor fifteen years ago may no longer be appropriate now that your children are responsible adults.

You should also review your deeds, bank accounts, investment accounts, and other assets to confirm ownership (individual, joint, with beneficiaries, in trust, etc.) to ensure consistency with your overall plan. Maybe you purchased a life insurance policy in 1965, naming your parents as beneficiaries, you have an IRA that names a now-deceased spouse as sole beneficiary, or your deed is still in your name when you have since created a trust. Do you need to make changes?

Maybe you have plenty of ways to spend your extra “at-home” time during this crisis. But if you need another activity, this “estate” scavenger hunt will not only provide you some peace of mind but your loved ones as well.

This article was provided by Jarrett & Luitjens Estate & Elder Law. For more information VermontEstatePlanning.com.

Related Articles

Important Legal Documents All Seniors Should Have

Comment here